More Low-end products developed as average price dropped

A few years ago, smart phones were still regarded a symbol of high-end consumer products, affordable only by business executives. Today, as the number of equipment makers in the market grows, technology matures and product models enrich, smart phones joined the popular end and became a more affordable product that targets a bigger community.

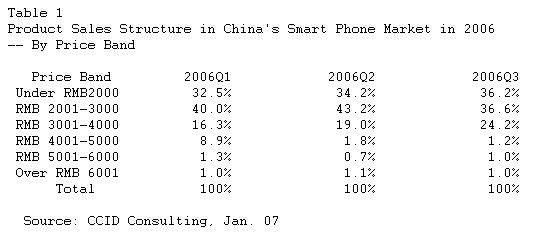

CCID Consulting's data show that in 2003 when the smart phone was still a novelty to the market, there were only over 30 models in the whole market. The number reached 87 in 2005 and topped 120 in 2006, with products in the RMB 1,000-4,000 price range performed best in the market. Driven by the sales of low- and middle-end smart phones, average product price in the market rapidly dropped in 2006, down to RMB2,450 from RMB3,176 in 2005.

Symbian continued to be the dominant operating system for mobile phones

Symbian OS continued to enjoy the biggest slice of the market. In 2006, Microsoft stepped up its efforts to promote its Windows Mobile OS. As for the secondary development of software platforms, it widely cooperated with terminal makers and many middle-stream and downstream software developers. This enabled the company to expand the use of Windows Mobile. It also attracted more terminal makers to join Microsoft's camp. However, with Nokia phones having the absolute advantages in the market, Microsoft had been unable to greatly increase its market share of its operating system. As Motorola maintained sales of its smart phone, Linux continued to retain its position as having the second largest market share among mobile phone operating systems.

CCID Consulting forecasts that competition in product segments will become a main feature of the smart phone market

As the whole smart phone market enters a growth period and develops towards a mature stage, many firms have, in addition to mainstream application functions, started to direct their main efforts at market segments where they can bring their advantages into better play.

In the smart phone market, Nokia and Motorola now take up over 90% of the market share, leaving a very limited market to other vendors. If these vendors want to get high returns from this highly profitable market, following the footsteps of big vendors is obviously not a sensible way for them to go. We can see that though smart phones can provide consumers with more personal information processing functions, it still cannot meet some groups' special needs or certain industry demands. These potential demands actually provide a room for the smart phone industry to dedifferentiate in the future.

Compared with ordinary mobile phones, smart phones provide users with more personalized application functions with the help of operating systems. Mobile phone makers are bound to open more market segments based on their own abilities and in relation to consumers' potential demands. Today, market segments such as GPS navigation, push-mail and information security have started to take off. In Beijing, the Chengguantong (All-in-One Municipal Administration) smart phone is being promoted on a large scale. All these actually forebode that future competitions in the smart phone market will become competitions in the market segments.