In the upstream display supply, excessive productive capacity and accordingly oversupply of LCDs has already become an issue of the whole world and the whole industry. Under the impact of worldwide LCD oversupply, the downstream terminal market saw lowered prices in the second half of 2006. As big-screen displays become more and more prevalent worldwide, LCD monitors will continue to suffer lower prices in the next one or two years.

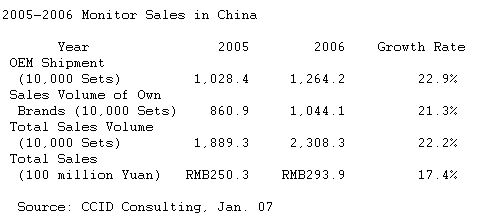

China's display market maintained a high-speed growth in 2006, with a sales volume of 23.083 million displays, an increase of 22.2% over 2005, and sales revenue of 29.39 billion Yuan, up by 17.4% year-on-year. Of this, sales of the own brands exceeded 10 million and reached 10.441 million displays, an increase of 21.3% year-on-year. OEM monitors had a sales volume of 12.642 million displays, up by 22.9%.

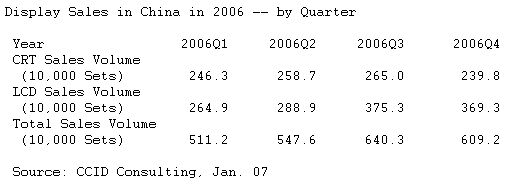

The quarterly market sizes for displays in 2006 were respectively 5.112 million, 5.476 million, 6.403 million and 6.092 million, which shows no distinct seasonal differences. The first quarter had the smallest market size due to the Chinese New Year; the third quarter saw the largest sales and virtually the expected market blowout because of new demands rising over the summer. LCD sales kept increasing as the quarters proceeded and the biggest increase occurred in the third quarter, which marked a sales volume of 3.753 million displays. In the meantime, CRT monitors began to slide from the third quarter and sales reduced to 2.398 million in the fourth quarter, the lowest quarterly sales since the first quarter of 2002.

CRT monitors entered the downward channel in 2005 and witnessed even faster downward movements on the Chinese Mainland in 2006, marking a decrease of 12.2% and a sales volume of 10.099 million displays. Local brand sales were 4.484 million and OEM sales were 5.615 million.

CRT market size dropped drastically, 15-inch CRT monitors accounted for merely 0.8% of the display market, a decrease of over 50% year-on-year; and the proportion of 17-inch CRT monitors decreased from 89.1% of the market to 83.4%. In contrast, 19-inch CRT monitors (mostly pure flat monitors) swept a larger proportion of the market, increasing from 9.1% to 15.4% and with sales of 689 thousand sets, up by 40% year-on-year.

East China continued to hold the largest share of China's CRT market; sales in 2006 reached 1.071 million in this region, surpassing the second in line, the North China region, by 132,000 displays. The South China market saw quick reductions and sales decreased by 21.2% over last year.

LCD monitors maintained high-speed growth in China in 2006 and started to enter a mature stage. Based on research of CCID Consulting, the market size of LCD monitors reached 12.985 million in 2006, an increase of 75.6% over last year. Drastic reduction in prices for various specifications of LCD monitors served a heavy strike at China's display market and sped up the LCD replacing CRT process. The proportion of LCD monitors in the market increased from 39.1% in 2005 to 56.3%, overtaking CRT monitors and becoming the mainstream product of the market.

LCD monitors witnessed a striking structural change in 2006. 19-inch LCDs were replacing 15-inch products on a universal scale and swept a much bigger proportion of the market; in the fourth quarter, 39.4% of LCD products were 19-inch, while at the same time 15-inch lowered to 3.2%. 3.933 million 17-inch LCD monitors were sold in 2006, accounting for 66.0% of the LCD market and becoming the absolute mainstream of the market.

In terms of regional markets, East China had an obvious advantage, accounting for 27.7% of LCD sales at 1.648 million displays, and North China and South China were the second and third in the line, accounting for 20.8% and 20.4% respectively. The East China region was the only market where own brands took over 60% of LCD sales, at 60.6%; and this proportion was the lowest in Northwest China, at less than 50%.

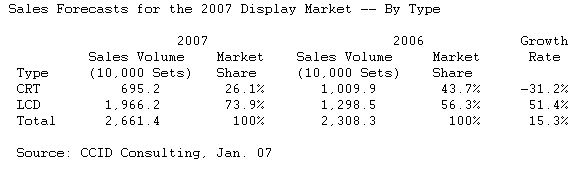

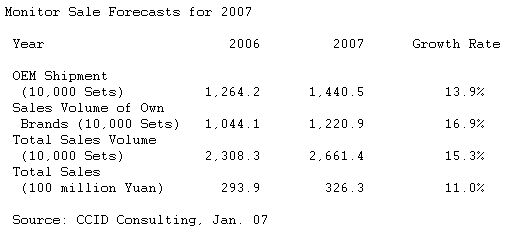

It is expected that OEM monitors will increase at a higher rate than the own brands in 2007, marking a growth rate of 16.9%. CCID Consulting forecasts that the Chinese monitor market will exceed 26 million in 2007 and reach 26.614 million displays in sales. Due to the upgrading of specific products and structural change, sales revenues will grow at a higher rate than sales volumes and reach 32.63 billion Yuan, marking an increase of 11.0%.

LCD monitors will continue to be the engine to drive the market growth in China in 2007, and LCD sales will get very close to 20 million, accounting for over 70% of the display market. Due to low demands, pure flat displays will start to enter a relatively long final stage of the life cycle, and sales will continue to drop quickly. It is expected that CRT shares of the market will see drastic reduction and the decrease rate will exceed 30%.