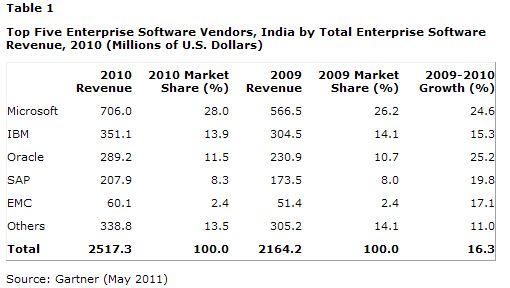

Four of the top five vendors experienced revenue gains above the industry average (see Table 1). Microsoft maintained the No. 1 position as it increased its enterprise software revenue market share in India to 28 percent in 2010. Microsoft’s results were enhanced in 2010 by the broader adoption of new releases of the Windows 7 operating system and Microsoft Office 2010 productivity software. Microsoft's total software revenue results were improved by new strategies aimed not only at individuals, but also at organizations and multiple delivery models. The company is placing more emphasis on enterprise application and infrastructure software programming platforms.

IBM maintained its No. 2 ranking in 2010 as it had in 2009. It would be the No. 1 enterprise software vendor if Gartner did not count consumer sales of Microsoft's office and operating systems. IBM sells only to enterprises and partners. The company's software revenue grew more than 15.3 percent in 2010, mainly due to its WebSphere, Tivoli, Information Mgmt., Operating Systems and Rational brands. IBM expanded dramatically in 2010 into the applications segment with a focus on e-commerce, marketing and sales with more than 20 industry solution frameworks as its "smarter planet" go-to-market strategy evolves.

Oracle showed the strongest growth among the top five vendors, as it increased its revenue 25.2 percent. Its growth was achieved across all software markets, with faster growth emerging from its business intelligence, security, IT operations, and data integration and quality tools offerings. Oracle has kept most acquired technologies intact while integrating the infrastructure and middleware into Oracle Fusion Middleware (OFM) 11g with some integration across the application portfolio. Oracle expects continued market momentum in its industry offerings, middleware, data quality and integration tools, master data management, database customer relationship management (CRM) and supply chain management (SCM) solutions.

Among the top 25 vendors in India, VMware led the group with more than 51 percent growth in 2010, followed by Cisco with more than 31 percent. The top 25 vendors accounted for nearly 94 percent share, or more than $2.3 billion, of the overall software market.

The enterprise software vendor landscape continues to change as mergers and acquisitions (M&As) are expected to continue as vendors and service providers look to expand their customer bases, add unique features aligned to a vertical-market or technology function, and improve overall market presence.